Read time: 7 minutes

I got laid off from Microsoft about a year ago, and it turned out to be one of the best things that ever happened to me.

Every few months I read news about big tech companies laying off thousands of employees, so it does not seem to be a rare event anymore.

And sadly most people are not prepared for it, which puts them in a very difficult situation out of nowhere.

So today I want to share with you what I did to be prepared before the layoff and how I moved forward after the layoff to not land into a financial crisis and take advantage of the situation.

Let’s dive in.

A few realizations

Even when I couldn’t even imagine that one day I could get suddenly terminated at Microsoft, 5 years ago (or so) a good friend introduced me to an amazing concept called financial independence, which put me on a path to saving and investing my salary, as well as figuring out ways to generate passive income.

So after diving into these ideas through a few books, podcasts and videos, I eventually realized a few important things:

1. You should not have all your eggs in one basket. It’s best to diversify your income streams. This way, if one of them fails, you still have others to rely on.

2. What you know has more value than you think. Yes, big tech companies pay well, but the knowledge and skills you accumulate over the years are worth much more than what they will ever pay you.

3. As an employee, you are trading time for money. Time is the most valuable asset you have because you are never getting it back. Instead of just trading it for money, it’s best to invest at least some of it in things that will pay you back exponentially in the future.

Those realizations opened my eyes and drove me towards taking action to secure my future, no matter what happens.

Before the layoff

These are the steps I took several years ago to be ready for the worst and invest in my future self:

1. Maximized my employee benefits

I started taking advantage of all the benefits that Microsoft offered, which I’m sure are similar to other big tech companies, like:

- 401(k) match: I contributed the maximum amount that Microsoft would match. It’s free money.

- Employee Stock Purchase Plan (ESPP): Allowed me to buy Microsoft stock at a discount up to a limit. One of my best investments.

- Health Savings Account (HSA): Contributions to this account are tax-free, the money grows tax-free and you can withdraw it tax-free for medical expenses.

2. Maximized my Roth IRA contributions

I opened a Roth IRA account and started contributing the maximum amount allowed by the IRS every year. And opened another one for my wife too.

You can invest the money put there in stocks, bonds, mutual funds, etc. and let it grow over time, but the great thing is that it grows tax-free and you can withdraw the money tax-free in retirement.

3. Invested only in index funds

Since I’m not a financial expert, I decided to invest the money saved in the 401k and Roth IRA (and in any investment money) only in index funds that track the S&P 500 or the total stock market.

This way, I’m not trying to beat the market, but I’m investing in the market itself, which has historically returned about 7% per year on average.

4. Built an emergency fund

I asked Microsoft to automatically deposit any extra money into a separate savings account on every pay period.

That account became my emergency fund and, by the time I got laid off, I had saved enough money to cover about 6 months of expenses in case the worse happened.

Interestingly, I have not touched the money on that account to this day.

5. Stayed on the bleeding edge of tech

As a Microsoft employee, you have the option to work on a crazy number of technologies and projects.

However, you have to be smart about which ones you choose to work on, or how much time you stay on a team that might not be pushing you to improve your tech skills.

Once I understood that the cloud and related technologies were the future, I did everything I could to transfer to teams and work on projects that would let me get real-world experience with Azure, Docker, Kubernetes and microservices.

Because of this, I developed a set of skills that are in high demand all over the tech industry today, and that I can put to good use in multiple ways.

6. Paid off all my debts

It did not feel like a big deal the day I paid off my house mortgage, but it was a huge relief when I got laid off about a year later.

Many people would advise you to never pay off your house mortgage because the interest rate is low and you can invest that money in the stock market to get a higher return.

But the peace of mind that comes with not having to worry about a mortgage payment every month (or car loan, credit card debt, etc) is priceless.

Now, I did have to pay a heavy tax bill because of selling all my stock options to pay off the mortgage, but I think it was worth it.

7. Started a side business

Once people started giving me positive feedback on my YouTube videos, and after a recommendation from another good friend, I decided to create my first Udemy course.

The day I made my first sale I realized, for the first time in my life, that (shockingly!) people were willing to pay for my knowledge.

Yes, companies had been paying for my knowledge for years (more like paying me to solve problems for them), but it was the first time that everyday people were willing to pay me directly for it.

That was a huge realization for me, and it opened my eyes to the possibility of creating a side business that could potentially replace my full-time income someday.

A few months later, I moved all my courses out of Udemy and into my own site (because Udemy takes most of the earnings), and I’ve been growing my business ever since.

The layoff

About a year ago, on an early Monday morning, I got the news that my job at Microsoft was being eliminated.

Since they never tell you why exactly you’re being laid off, I can only speculate on what happened, so I won’t go into that.

But as surprising and concerning as this news was, it also came with a couple of good things:

1. I got a nice severance package. They essentially asked me to stop working immediately and put 100% of my time into figuring out the next steps in my career. Plus they kept paying me full salary for about 3 months and kept paying for my health insurance for 6 months.

2. I could put 100% effort into my business. I had been working on my side business every day from 5am to 8am, and then every minute I could squeeze from 9pm to 11pm. It was exhausting but rewarding, but now I had the entire day available to grow the business.

Everything I did to prepare for this shocking event paid off at this time, and even when the future was uncertain, I felt confident that I could figure it out.

After the layoff

Here’s what I did next:

1. Did not look for a new “job”

Yes, I could update my resume and start applying for jobs all over LinkedIn, which is what most people do in these situations.

But I had been preparing for this moment for years, and I had a business that was already making some money, so I decided to put all my effort into growing it.

It was a scary decision, but I knew that if I could make it work, I would never have to worry about getting laid off again.

2. Invested in my business

I continued investing all the money I was making from my business back into it.

This not only meant paying for the business expenses but also investing in learning how to do marketing, sales, and serving my customers better than anyone else.

I also made sure the business was paying for itself and was profitable from the start. I did not want to rely on my emergency fund to keep it running, and I never did to this day.

3. Understood the value of giving more for free

Eventually, and to this day, the challenge is to get the business to grow enough to produce enough income that can pay the bills.

It took me a while to realize it, but the best way to grow a business is to give away as much value as you can for free.

Sounds crazy, but it’s true. The more value you give away for free, the more people will trust you and eventually choose to buy from you.

So I focused on creating the best free content I could on my YouTube channel, on LinkedIn and on this weekly newsletter.

Did I make the right choice?

I’m not becoming a millionaire anytime soon, but I’m making enough money to pay the bills, which is something I could not have imagined just a few years ago.

Remember, this is money I’m making out of thin air, just from my knowledge and experience, paid by normal people directly to me, and is not capped by any salary.

Still have to figure out how to deal with health insurance (so expensive in the US), but we’ll get there.

I’m also working on projects that I love, and I’m helping people all over the world to become better software engineers, which is something I’m very proud of.

So, yes, I think I made the right choice.

Would this work for everyone?

I think everything I did before the layoff, except for starting a side business, is something that everyone working in tech should do, no matter what.

If you are earning a good salary, especially if you are working for a big tech company, you should take advantage of all the benefits they offer and invest in your future self.

Otherwise, you are leaving a lot of money on the table.

Starting a side business is not for everyone. It’s a lot of work, but if you are willing to put in the effort, it can pay off in ways you can’t even imagine.

A few books that helped me

Here are a few books that helped me tremendously in shifting my mindset around wealth and work, and just by chance also prepared me for the layoff:

-

The 4-Hour Workweek by Tim Ferriss: Essentially makes you realize that you don’t have to work more to make more money, in fact, you can work less and make more money.

-

Rich Dad Poor Dad by Robert T. Kiyosaki: Explains the difference between working for money and having money work for you.

-

The Simple Path to Wealth by JL Collins: Explains how to invest in index funds and achieve financial independence.

-

The Millionaire Next Door by Thomas J. Stanley: Explains how most millionaires live and how you can become one.

-

Profit First by Mike Michalowicz: Explains how to manage your business finances in a way that guarantees profitability.

-

How To Get Paid For What You Know by Graham Cochrane: Explains how to turn your knowledge, passion, and experience into an online income stream in your spare time.

Hope you find them as useful as I did.

Whenever you’re ready, there are 3 ways I can help you:

-

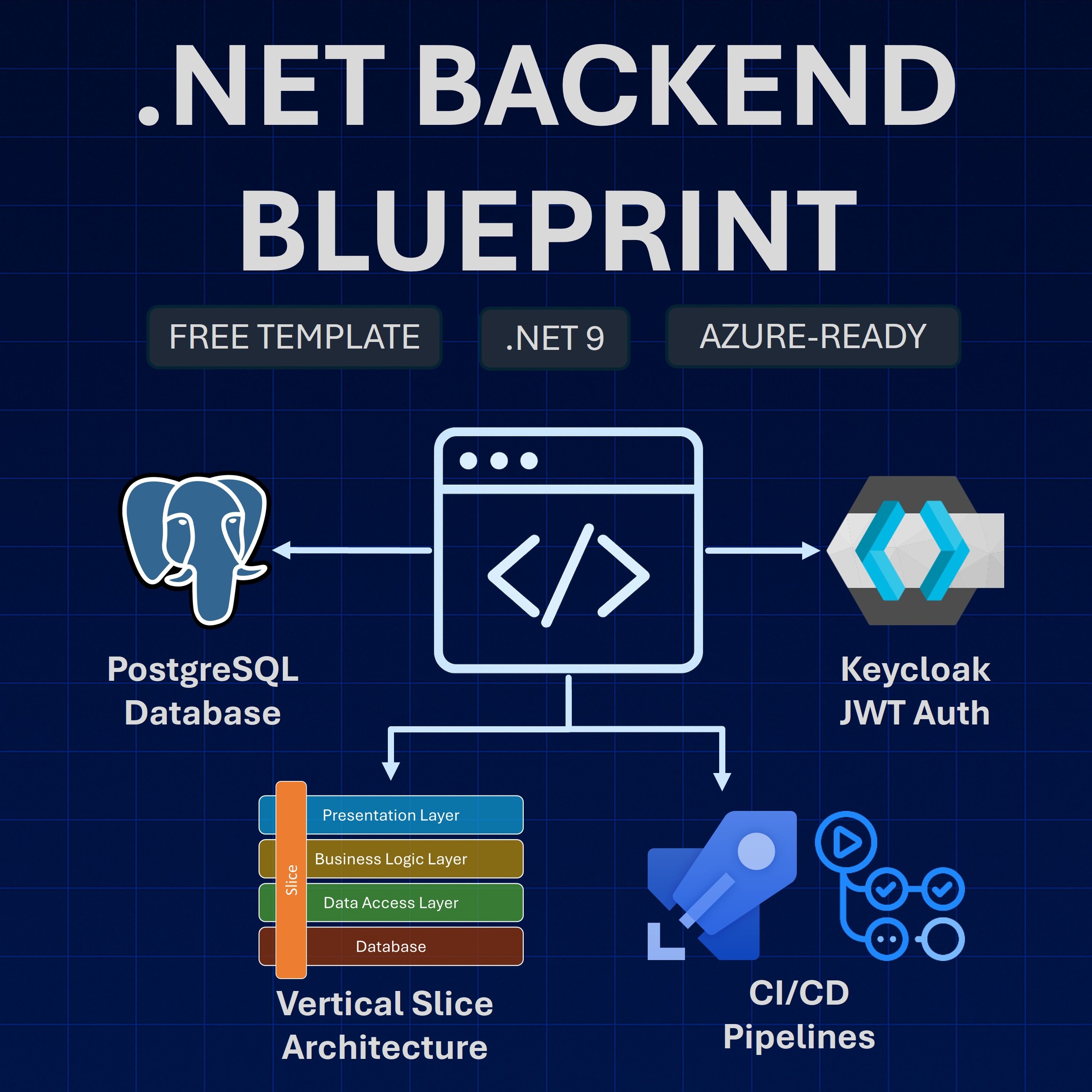

.NET Backend Developer Bootcamp: A complete path from ASP.NET Core fundamentals to building, containerizing, and deploying production-ready, cloud-native apps on Azure.

-

Building Microservices With .NET: Transform the way you build .NET systems at scale.

-

Get the full source code: Download the working project from this article, grab exclusive course discounts, and join a private .NET community.